According to recent sources, Samsung, Amazon, Apple, Intel, and Nvidia are planning to invest in Arm. Almost all modern mobile devices have their core components designed by the British company Arm. Arm’s long-term financial stability will be a result of investments from all of the major global semiconductor chip manufacturers.

According to Nikkei, chipmaker Arm intends to issue shares through an IPO (Initial Public Offering) in September 2023. This action follows Nvidia’s recently unsuccessful $40 billion effort to acquire Arm. The value of Arm at the time of its anticipated IPO is anticipated to exceed $60 billion, making it the largest IPO of the year globally. Currently owned by the Japanese SoftBank Group, which will later this month submit an application to the US SEC (U.S. Securities and Exchange Commission) for Arm’s listing. The Nasdaq Stock Market must then provide its permission.

Samsung and other companies want to invest in Arm so they may influence its management.

Since SoftBank bought Arm in 2016 for £24 (about 31 billion at the time), the company’s sale price has almost doubled, and the company anticipates more market appreciation. Currently, SoftBank controls 75% of Arm, with the other 25% held by its global tech investment fund, SoftBank Vision Fund. According to reports, the SoftBank Vision Fund intends to float 10% to 15% of its Arm holdings. Big-name semiconductor manufacturers like Apple, Samsung, and Amazon can help here. They should be medium- to long-term investors who provide Arm with stability throughout the long haul. Additionally, they want to influence Arm’s leadership.

If you recall, Arm altered its license guidelines last year following Qualcomm’s purchase of Nuvia. Former Apple and Google chip engineers founded Nuvia, which created CPU cores based on ARM’s designs. Arm asserted that Nuvia’s license to use Arm’s chip designs could not be transferred to Qualcomm when Qualcomm acquired Nuvia.

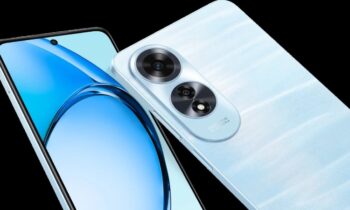

Arm currently charges end-device manufacturers like OPPO and Xiaomi for their chip designs as opposed to chip designers like Qualcomm and MediaTek. The company, however, intends to switch to charging device manufacturers as its new business model. Additionally, it is said that the prices would be determined by how much the equipment costs, which will bring in much more money. When an organization is listed on a stock market, high income is seen to be crucial for good performance. It might also have an impact on Samsung’s Exynos chips, which combine AMD GPU cores with ARM Cortex CPU cores.

Future versions of RISC-V could pose tough competition to Arm

Although Apple and Samsung are both semiconductor and device manufacturers and may have complex and lengthy license deals with Arm, doing so would be beneficial for them in the long run. The open-source and royalty-free alternative chip design architecture RISC-V, however, may be adopted by device manufacturers as a result of Arm’s new business strategy. Google has promoted RISC-V to a Tier-1 architecture for Android devices in light of all the controversy surrounding Arm.